What Exactly Is An OKR In Finance?

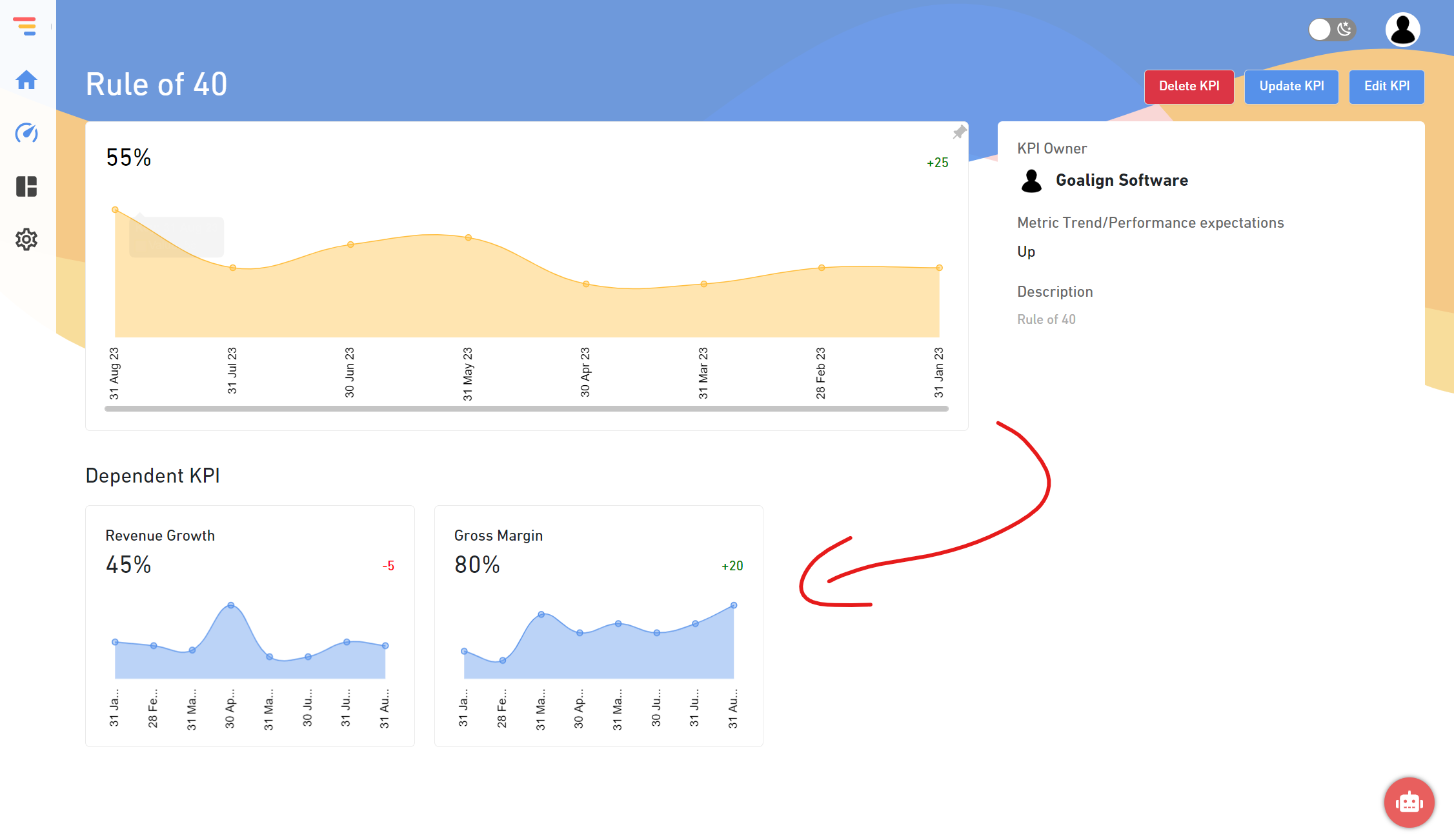

Finance plays an essential and frequently critical role in implementing OKRs. Finance Leaders, such as the Chief Financial Officer, not only engage in Company Strategy and OKR planning talks, but they are also frequently the guardians of a company’s most critical measurements (KPIs) and, as such, are usually aware of the objectives that have been set. You may make these KPIs visible and accessible in ZOKRI as KPIs or, as they are commonly called, ‘health metrics.’ Retention and Growth Rate are two examples of such KPIs.

Your OKR Success Requires Initiative Planning As Well

In the preceding instances, metrics offer quantifiable results that depict the expected future condition after a quarter or a year. Initiatives refer to the work you want to accomplish, your activities, industries, and tasks that will be undertaken to effect the desired change. Enterprises to achieve the results might include improving current accounting technology, adopting a new expenditure management software solution, better process design, team education, and hiring.

Finance Teams

The accounting staff of a financial department serves as its foundation. It is in charge of creating balance sheets, financial statements, cash-flow reports, and day-to-day record keeping and reporting, which includes all payroll and accounts payable and receivable. It is also in charge of managing and carrying out all internal audits and controls and tax and reporting tasks. It ensures that the organization complies with regulations and is financially sound. Among the several accounting positions are:

Reports and record-keeping

This entails keeping track of all transactions and financial occurrences and maintaining accurate records. These records are kept carefully for several years to show the organization’s progress – whether it is profitable or losing money – and keep track of funds owing to investors and other partners.

The records of an organization are used to budget and estimate the future. They are audited by banks, tax officials, and external auditors to ensure that everything is in order.

Deferred Revenue and Accounts Payable are two types of accounts

Accounts payable (AP) is the department of a finance team in charge of making payments to third-party vendors for products or services.

Accounts receivable (AR) is an organisation’s money from consumers/clients in exchange for goods or services. Reminders, interest charges, and late fees will also be sent.

Receivables and payables are often tracked using a computer system and examined after a period. This guarantees that all money coming in and out of the firm is followed and that all credits and debits are in sync.

Payroll

Payroll is an essential operation that ensures all workers are paid correctly and on schedule. A payroll department also provides that taxes, pension payments, and other benefits are accurately computed and delivered to the appropriate agencies on time.

Controls over finances

A financial controller is a senior member of an accounting team that ensures that all financial procedures adhere to legal rules and are free of fraud and theft by adopting specific internal controls. They supervise all economic activities to ensure that they are correctly reconciled and correct all transactions. Financial controllers also communicate with external auditors.

Risk Management

Risk management teams may discover, assess, prioritize, and mitigate risks that influence a business and its activities. A risk manager strives to foresee internal and external changes and utilizes available resources to reduce and monitor the effect of these changes.

Capital Planning

Capital budgeting considers numerous investment alternatives and projects. Capital budgeting may be used for various purposes, including land acquisition, mergers, and the purchase of a fixed asset such as new machinery. The objective is to select initiatives that generate profitability, maximize it, and ensure that it raises the capital and growth of the organization.

Treasury

The treasury team manages and controls an organization’s cash and ensures that there is always accessible enough to satisfy the business’s urgent demands. Treasurers collaborate with other departments to estimate and foresee the company’s future requirements and make investments to assure a consistent stream of revenue.

Financing

Financing entails the availability of capital, the organization’s costs and responsibilities, and revenue streams. It calculates the amount of money and detects various sources of revenue, such as investors or banks.

Finance OKR examples

Cash is the lifeblood of every business. The finance department’s responsibility is to manage the firm’s cash flow, income, and costs and ensure that the organization has the resources it needs to fulfil its strategic objectives.

1. Profit and revenue Examples of OKRs

Objective 1: Set new records for revenue and profitability.

Key Results:

- Increase quarterly revenue from $2.2 million to $3 million.

- Pre-orders for the upcoming quarter will be increased from $1.05 million to $1.5 million.

- Increase the quarterly profit to $900,000 from $660,000.

- Reduce operational costs from $1.5 million to $1.3 million.

Objective 2: Increase Monthly Recurring Revenue by a factor of two (MRR).

Objective 1: Clarify our product message in preparation for the new product launch.

Key Results:

- Conduct ten on-site user-testing sessions to understand TA further.

- Investigate and install 20 new distribution channels for our content.

- Run 20 different Facebook advertisements and track their performance.

- Prepare the new product presentation and test it with five consumers.

Objective 2: Increase Monthly Recurring Revenue by a factor of two (MRR).

Key Results:

- Raise the MRR from $160,000 to $320,000.

- Increase the average membership size from $350 to $500 per month.

- Increase the percentage of monthly subscriber renewals from 64% to 85%.

- Lower the monthly churn rate from 3.8 percent to 2%.

2. Fundraising and budgeting OKR Case Studies

Objective 1: improve weekly budgeting and scheduling.

Key Results:

- Before October 12, sign the business line budget proposals.

- By November 25, the final yearly budget must be approved.

- Reduce the budget approval timeframe from 46 to 20 days.

- Attain a satisfaction percentage of 80% with the new budget approval procedure.

Objective 2: Develop a financial strategy for the next three years.

Key Results:

- Prioritize the product plan by October 10.

- Budgets must be finalized and approved by October 30.

- Raise $10 million for next year’s growth ambitions.

3. OKR examples in tax and business

Objective 1: Improve operating effectiveness.

Key Results:

- By November 15, conduct an external accounting audit.

- Complete the vendor procurement procedure.

- Work with the Head of Sales to finalize the new deal guidelines procedure.

Objective 2: Increase tax compliance.

Key Results:

- Audit adjustments should be reduced from 3% to 1%.

- Lower the number of fee issues/complaints every month from 5 to 1.

- Reduce the percentage of Accounting Records holds from 5% to 1%.

- Conduct an external audit of tax compliance.

Conclusion:

Finance teams must integrate various parts of the company. Helping to develop strategy, establishing controls that allow the organization to track and respond to change, reporting, and, of course, day-to-day operational parts of finance such as payroll. OKRs for the finance department might include all or any of these. It all depends on your priorities.

It is challenging to create strong, well-structured, and successful OKRs. OKRs will raise team involvement, motivation, and performance if you have the grit to go through several iterative improvement cycles. Use the examples above for ideas and inspiration while creating your own OKRs.